georgia ad valorem tax out of state

As a result the annual vehicle ad valorem tax sometimes called the birthday tax is. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes

In this example multiply 40000 by 066 to get 2640 which makes the total purchase price 47640.

. This tax is based on the value of the vehicle. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Buyers must pay this Title Fee on all vehicle sales including private sales and the Title Fee applies to all vehicles.

The legacy system was that you paid sales tax at the time of sale or in the case of out-of-state sales at the time of registration in the state of Georgia. Vehicles subject to TAVT are exempt from sales tax. TAVT rates are set by the Georgia Department of Revenue.

Cars Purchased On or After March 1 2013. The actual filing of documents is the veterans responsibility. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from the sales and use tax and the annual ad valorem tax.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to. Being changed to a state and local title ad valorem tax or TAVT. New residents moving into Georgia are required to register and title their vehicle in Georgia and must pay TAVT in an amount equal to 3 of the fair market value of their vehicles.

Thereafter there is no annual ad valorem tax but an additional TAVT. Currently 50 out of the 1079 zip codes in Georgia. If you are registering a new title for a car purchased out of state you will still be.

You are still required to annually register your vehicle in your home county and pay the associated 20 standard renewal fee or any additional renewal fees in the case of specialty tags. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This calculator can estimate the tax due when you buy a vehicle.

If itemized deductions are also. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for. Two common vehicle taxes implemented in this state are the Title Ad Valorem Tax and the Annual Ad Valorem Tax.

Use Ad Valorem Tax Calculator. After that you paid annual ad valorem tax at a lower rate. Ad valorem tax receipts are distributed to the state county schools and cities.

However if you bought the car out of state for 45000 and registered it in Georgia then the state and local tax rates apply. Instead the purchased vehicles are subject to the new one-time TAVT. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

The TAVT imposes a title tax at the time of purchase or initial registration in the state. Learn how Georgias state tax laws apply to you. The tax must be paid at the time of sale by Georgia residents or within six months of.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Rental tax and lodging tax. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66.

Where Your State Gets Its Money

Live Atlanta Stadium Atlanta Georgia The Beatles Bible The Beatles Live The Beatles Atlanta

The Most And Least Favorite Us State Of Each State Mapped Vivid Maps Funny Maps Map State Map

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Vehicle Taxes Dekalb Tax Commissioner

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Property Tax Map Tax Foundation

We Rated Every State For Taxes Based On State Income Taxes Local Sales Taxes Gas Taxes And More Find Out Where Your State Ranks Usa Map Map Gas Tax

State Tax Levels In The United States Wikipedia

Which States Have The Lowest Property Taxes

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Economics Taxes Economics Notes Accounting Notes Business Notes

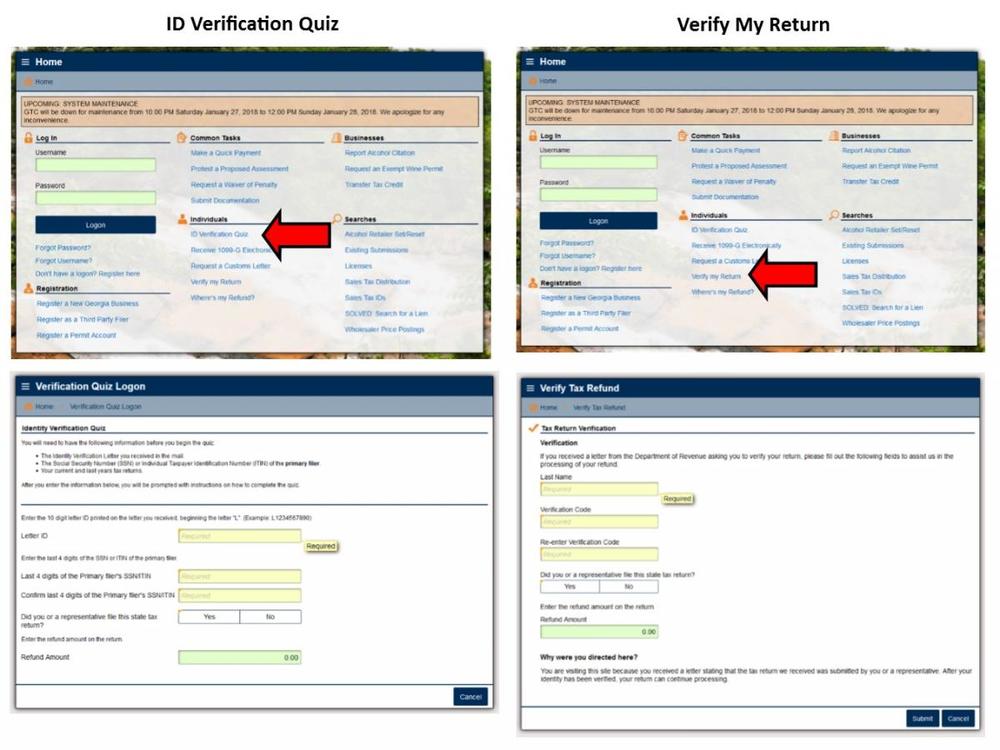

Return Verification Id Verification Quiz Georgia Department Of Revenue

Cypress Texas Property Taxes What You Need To Know

Carroll County Board Of Tax Assessors

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

Business Personal Property Tax Return Augusta Georgia Property Tax Personal Property Tax Return